Finance is Eating the Internet: The Rise of Internet Capital Markets

Underestimating the Internet – A Lesson learned

I was practically raised in a television studio. My family owned four TV stations and a radio station, spread across four cities in two states of Brazil. For decades, we dominated local airwaves. We thought traditional broadcast media were invincible, a cash-printing cornerstone of every community. When the internet started gaining traction, we saw it as a sideshow, not a serious threat. We underestimated it badly.

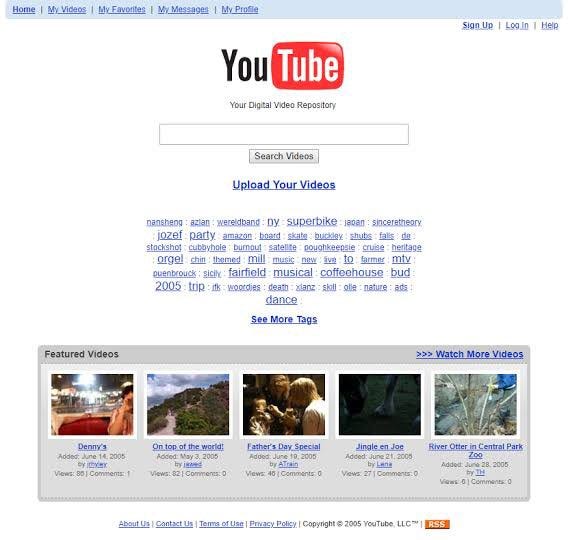

In hindsight, the signs were there. Between 2000 and the mid-2010s, the free-to-air TV audience in Brazil dropped by roughly 28% while internet usage soared by around 400%. By the mid-2010s, over half of the Brazilian population was online. YouTube, which launched in 2005, exploded in popularity alongside rising broadband and mobile access. Suddenly, anyone with a phone and an internet connection could watch and create content, bypassing the gatekeepers of TV. Our once-loyal viewers were spending their hours on YouTube and Facebook instead of our channels. Advertisers followed the eyeballs.

Yet from the inside, traditional media still felt untouchable. We had decades of regulatory moats, relationships, and content production expertise. But the internet didn’t care. It rewrote the rules of distribution overnight. By the early 2010s, we saw the writing on the wall… local TV revenues stagnating, internet advertising climbing fast. We decided to exit our media business in 2015, thankfully just in time. The very next year, Brazil’s economy plunged into a severe recession (GDP fell 3.8% in 2015, the worst slump in 25 years), which only accelerated the decline of regional TV. Many local broadcasters never recovered. What had seemed like an invulnerable industry was disrupted in a flash by an internet-centric model no one in traditional media took seriously until it was too late.

This was my first up-close lesson in a technological revolution. We lived the information revolution as it hit the media. I saw how a dominant industry can be blindsided by a new network that expands access, tears down barriers, and enables completely new behavior. That experience seared into me a healthy paranoia: never underestimate the internet.

TradFi’s Turn – Underestimating the Onchain Revolution

I saw parallels in traditional finance (TradFi). By the late 2010s, as crypto and decentralized finance (DeFi) emerged, many finance veterans reacted just like the TV moguls had with the internet: with disbelief, dismissiveness, even ridicule. In 2017, JPMorgan’s CEO Jamie Dimon famously sneered that Bitcoin “is a fraud” that would eventually blow up. (He even said he’d fire any trader at his bank who touched it as they would be “stupid”.) Legendary investors like Warren Buffett derided crypto as “rat poison squared.” The consensus in much of Wall Street was that crypto was a fad – good for headlines, perhaps, but not a serious challenge to the financial establishment.

Sound familiar? To me, it felt exactly like when print and broadcast executives once scoffed at blogs, YouTube, and Netflix. Today, many in TradFi still believe crypto is at best a speculative toy and at worst a scam. They see the crypto markets as tiny in the context of global finance, and DeFi protocols as experiments that can’t possibly replicate the stability or scale of traditional banks and exchanges. But just as with the internet and media, this underestimation is a grave mistake.

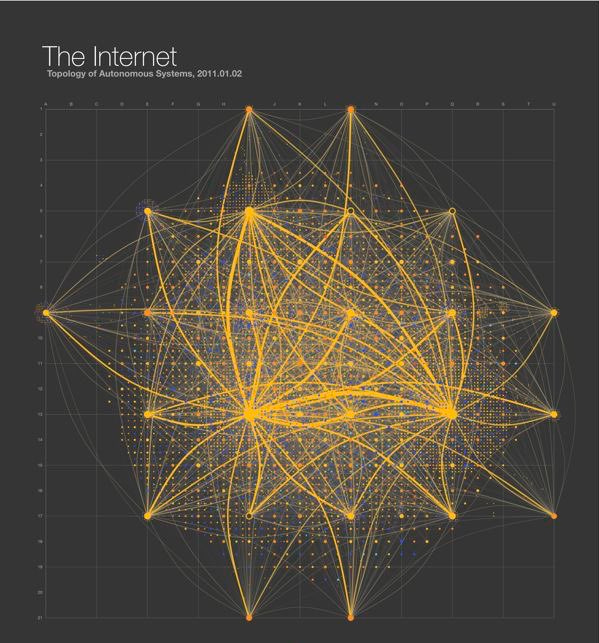

Behind the scenes, an entirely new financial system has been quietly gaining momentum onchain. Piece by piece, the core primitives of capital markets are being rebuilt on public blockchains. I’ve come to call this phenomenon Internet Capital Markets Finance (ICMfi) – essentially, the recreation of capital markets on the open internet rails of crypto. Much like DeFi broadly, it’s an effort to replicate the functions of traditional finance using blockchain-based smart contracts that are composable, interoperable, and open source. But ICMfi goes beyond just replication; it extends these primitives with the superpowers of software: programmability, global accessibility, 24/7 markets, and instant settlement.

Let’s unpack this. In traditional finance, we have well-known mechanisms: raising capital through IPOs, trading on exchanges with market makers and brokers, borrowing and lending via banks or bond markets, investing via funds and asset managers, mitigating risk via insurance and derivatives, and so on. What’s happening now onchain is not a random crypto casino – it’s a systematic rebuilding of these same primitives, but on internet infrastructure. And just as the internet did to media, this new architecture unlocks capabilities impossible in the old system.

The Rise of Internet Capital Markets (ICM)

Under the hood of the crypto world, innovators have been constructing a parallel universe of finance native to the internet. These Internet Capital Markets implement similar processes to traditional capital markets, entirely on-chain. In an Internet Capital Market, a project or company can raise funds by issuing a token to the public, just as companies issue stock, except it happens on a blockchain, open to anyone. As one blockchain security firm describes it, ICMs create open marketplaces on the blockchain, where tokens representing ownership in a venture can be automatically generated and made accessible to users and investors around the world. In other words, the concept of an “IPO” is being reimagined as a TGE (Token Generation Event) or similar onchain offering. Anyone with an internet connection can participate; there are no gatekeepers or underwriters deciding who gets allocation. ICMs operate on global, permissionless public blockchains, eliminating the geographic and regulatory gatekeepers that traditionally limit who can invest where.

Crucially, these onchain markets inherit the internet’s characteristics: 24/7 trading, worldwide reach, and composability (meaning different financial contracts can plug into each other like Lego blocks). A startup can spin up a token and list it within minutes, raising capital from a global pool of believers, rather than spending months navigating IPO paperwork and roadshows. An algorithmic market maker (a smart contract) will start providing liquidity for that token from day one, enabling instant trading. All of this can occur with transparency (every transaction visible onchain) and without centralized intermediaries taking large fees. This is finance at the speed of the internet.

To paint a clearer picture, here’s a quick TradFi vs. Onchain comparison of key capital markets functions:

Initial Public Offerings (IPO) → Token Generation Events (TGE)/ICOs: In TradFi, companies go public via IPOs on stock exchanges, usually accessible only to institutional investors or those in certain jurisdictions. In ICM, projects conduct onchain token launches (ICOs, TGEs, etc.) that anyone globally can join. The barrier to creating and distributing a token is extremely low – launching a token can be as simple as deploying a smart contract or even tweeting a command, as some platforms now allow. This democratizes access to early-stage investment. (Of course, it also introduces new risks of scams – more on the gaps later.)

Exchanges & Market Makers → Decentralized Exchanges (DEXs) & Liquidity Pools: Traditional stock exchanges and FX markets rely on market makers/specialists to match buyers and sellers, operating during set hours. Onchain, automated protocols like Uniswap perform this function using liquidity pools and algorithms. Smart contracts replace market makers, allowing users to trade any time, from anywhere. The result? Decentralized exchanges like Uniswap now often handle comparable trading volumes to major centralized exchanges – in fact, Uniswap’s trading volume surpassed Coinbase’s in certain periods of 2023. This is a stunning validation of onchain market infrastructure: an automated internet protocol for trading can outpace a large Wall Street-born exchange in volume and liquidity. The internet is eating finance, one swap at a time.

Custodians & Clearing → Self-Custody & Instant Settlement: In TradFi, assets are held by custodians (banks, brokers) and trades take days to settle through clearinghouses. In the onchain model, assets live directly in your crypto wallet (self-custody), and trades settle in minutes (or seconds) as blockchain transactions. “Not your keys, not your coins” is the mantra – you control your assets with private keys, and you don’t need a third party to hold or verify ownership. This vastly reduces counterparty risk and streamlines settlement – although it requires users to take on the responsibility of securing their own keys. Meanwhile, back-end clearing and record-keeping is handled by the blockchain’s consensus, not by DTCC or custodial banks.

Funds & Asset Managers → Smart Contract Vaults & DAOs: In traditional markets, you might buy into a mutual fund or have an asset manager handle your portfolio. In DeFi, vaults and yield aggregators fulfill a similar role via code. A great example is Yearn Finance – its “Vaults” are like actively managed mutual funds where the investment strategy is executed by self-executing code. You deposit crypto into a Yearn vault, and smart contracts automatically deploy that capital across lending protocols or yield farms to earn the best return. No human fund manager needed; the strategy runs 24/7 and autonomously rebalances. Participants receive vault tokens that represent their share of the pooled fund, accruing value as the strategy profits. Beyond vaults, some DAOs (decentralized autonomous organizations) now act as onchain investment funds or treasuries, allocating capital based on token-holder votes rather than directives from a CEO. This flips the script on asset management – anyone can pool assets and collectively decide on their deployment, all mediated by code.

Bonds & Loans → Onchain Lending Markets and Yield-Bearing Tokens: Traditional credit markets involve banks or bond issuances that mostly only institutions can access. Onchain, protocols like Aave, Compound, and MakerDAO enable anyone to lend or borrow instantly by supplying crypto collateral. These are essentially decentralized banks that run on code – depositors earn interest (often via yield-bearing tokens that represent their lending position), and borrowers pay interest, all without an intermediary bank. Even real-world assets are joining in: government bonds and other yield-bearing instruments are being tokenized so that onchain investors can hold and trade them. For instance, the market cap of tokenized stocks and bonds recently surpassed $200 million and is climbing, opening the door for investors globally to get exposure to things like U.S. Treasury yields on-chain. In a world of low DeFi yields, interest-bearing tokens backed by real-world loans or bonds are becoming the onchain equivalent of fixed-income assets – effectively bonds 2.0 living on the internet. (Imagine a token that automatically pays you a stable yield – that’s where this is heading.)

Derivatives & Complex Products → Onchain Derivatives & Composables: Financial engineering is also moving onchain. Platforms like dYdX and GMX offer perpetual swaps and futures that mirror traditional derivatives, but settled in crypto and accessible to anyone with a wallet. Synthetic asset protocols create tokens that track stocks or commodities. And because everything is software, you can compose these pieces: take a yield-bearing token and use it as collateral to mint a stablecoin, or trade a tokenized Tesla stock on a DEX at 3 AM Sunday. We’re seeing the emergence of composable finance: you can stack various financial primitives (lending, trading, insurance, derivatives) together programmatically to create products not possible in TradFi. The possibilities here are endless – new structured products can be spun up by anyone as smart contracts, not just by Goldman Sachs.

In summary, Internet Capital Markets are rebuilding the entire financial stack onchain. The thesis is that anything TradFi can do, onchain can do as well – but faster, more openly, and with new superpowers. This isn’t just theoretical: many of these onchain analogs are already functioning at significant scale (hundreds of billions of dollars flow through DeFi protocols annually). We’re essentially watching a cryptographic software suite replicate the global financial system.

Yet, as a passionate builder in this space, I’m not blind to the challenges. For ICM to truly go mainstream, several gaps still need to be filled.

Gaps to Fill: What’s Still Missing in ICM

For all the progress in DeFi and ICM, there remain critical pieces of market infrastructure that are either immature or completely absent onchain. If we draw a parallel to the early internet, it’s as if we have built the web browser and some websites, but we’re still missing the robust search engines, security protocols, and regulations that Web 1.0 eventually developed. Here are some key gaps that I see, which ambitious founders and the community are now working to close:

Robust Risk Management and Safety Nets: Traditional finance has layers of risk management – think FDIC insurance on bank deposits, lender-of-last-resort facilities, well-defined bankruptcy processes, etc. In DeFi, those safety nets are rudimentary. There’s no onchain equivalent of deposit insurance or a central bank to backstop a liquidity crisis. We do have DeFi insurance protocols and risk funds, but they are small and sometimes unproven. We also lack standardized risk assessment for protocols – for example, how do we reliably rate the smart contract risk or economic risk of a given lending pool? Efforts are underway (even Moody’s is exploring onchain credit ratings), but the ecosystem would benefit from more sophisticated risk analytics and perhaps decentralized insurance pools to cover failures. Simply put, we need the “risk layer” of ICM to mature so that big money can participate with confidence.

Identity and Credit Infrastructure: While open access is a strength, the pseudonymous nature of onchain finance makes unsecured lending nearly impossible today. Nearly all DeFi lending requires over-collateralization – you typically must post $150 of crypto to borrow $100, which limits capital efficiency and use cases (it’s like a mortgage market where no one trusts anyone’s credit, so every loan is 200% collateralized!). In TradFi, of course, most credit is based on reputation and credit scores, not just hard collateral. This is a huge gap: DeFi lacks robust credit scoring and identity mechanisms to enable under-collateralized loans. ICMfi will need ways to assess borrower trustworthiness, possibly via onchain credentials, reputation tokens, or integration of real-world identity (in a privacy-preserving way). The good news is people are working on it – for instance, zero-knowledge proof systems that could let a borrower prove they have a good credit score or income level without revealing their identity are in development. Once we crack decentralized credit scoring, we unlock true onchain credit markets (imagine getting a mortgage or business loan from a DAO!). Until then, the lack of under-collateralized lending remains a bottleneck.

Institutional-Grade UX and Integration: Let’s be honest – using DeFi today can be clunky and intimidating, especially for institutions or newcomers. Managing private keys, figuring out Metamask, worrying about hacks – it’s a far cry from the polished interfaces and customer support that institutions expect. For ICM to gain institutional adoption, user experience for large players needs to improve. This means better custody solutions (e.g. MPC wallets, multi-sig safekeeping that feel as secure as a bank vault), easier compliance integration (tools to whitelist addresses, manage reporting), and overall cleaner interfaces that abstract away blockchain complexity. There is movement here: “CeDeFi” platforms and institutional gateways are emerging, and even big custodians like Fidelity are rolling out crypto products. But we have to continue bridging the gap so that interacting with onchain markets becomes as straightforward for a pension fund or corporate treasury as using an online brokerage. When a risk officer can comfortably approve using a DeFi yield vault because the interfaces and guardrails meet their standards, we’ll have unlocked a wave of institutional capital.

Regulatory Clarity and Legal Frameworks: Perhaps the tallest wall to climb is regulation. Right now, DeFi exists in a gray zone in many jurisdictions. Who regulates an automated, global protocol? If a token looks like a security, how do laws apply when there’s no traditional issuer? Major economies are grappling with these questions. Some jurisdictions have begun providing guidelines – for example, the EU’s recent MiCA regulation is a step toward a comprehensive crypto framework, and jurisdictions like Singapore and the UAE are creating licensing paths for crypto markets. But by and large, policy is lagging technology. The World Economic Forum noted that DeFi remains an area of “less regulatory clarity” and that governments need more time to craft appropriate rules. For ICM to truly flourish, we need smart regulation that protects against fraud and systemic risk without strangling innovation. Clarity on how tokens are classified, how KYC/AML should be handled in DeFi, and how onchain contracts can be recognized in legal terms will help unlock the next phase. The encouraging aspect: forward-thinking regulators are starting to engage (I even saw U.S. congressional hearings where DeFi was discussed not as a dirty word but as an innovation to accommodate). The next few years will likely bring much more definition to this space – a necessary foundation for large-scale adoption.

Each of these gaps is an opportunity. Just as early internet companies built the missing pieces (search engines, payment processors, security layers), there are founders today building decentralized identity protocols, regulated onchain credit platforms, better wallets, and legal advocacy for sensible DeFi regulation. ICM doesn’t need to replicate every aspect of TradFi overnight – it simply needs to gradually fill in the cracks so that onchain finance can achieve parity (or superiority) in safety and ease of use. When that happens, the case for using Internet Capital Markets becomes overwhelmingly compelling for everyone.

Proof of Momentum: Real IPOs Are Coming OnChain

Critics often say, “This all sounds great in theory, but is any of it happening in reality beyond crypto tokens?” The answer now is yes. 2024 and 2025 have brought concrete examples of ICM principles bleeding into traditional markets. The clearest proof point: actual regulated stock exchanges moving toward onchain integration. A landmark case emerged in May 2025 in Kazakhstan, of all places. The Astana International Exchange (AIX) – a young stock exchange in a frontier market – signed a memorandum of understanding with the Solana Foundation and a DeFi platform (Jupiter) to develop a dual-listing mechanism for real-world IPOs. In plain English, they are exploring letting companies conduct an IPO on the conventional AIX exchange and simultaneously issue a tokenized version of those shares on the Solana blockchain.

Think about that: a company could sell equity through AIX to traditional investors, while also making the same equity available as a Solana program token that can trade 24/7 globally. This is exactly the convergence of TradFi and ICM that I’ve been talking about. AIX’s CEO put it nicely, saying this agreement is “a significant step toward the convergence of conventional capital markets and next-generation blockchain-based platforms.” It underscores that even regulated exchanges see the writing on the wall – capital markets are heading onchain. The partnership aims to “broaden access to capital markets” and give companies the best of both worlds. In practice, this could mean a future where any IPO on AIX (or another exchange) could instantly have a token version trading on a blockchain DEX, increasing liquidity and reach. The fact that a stock exchange and government regulators (through AIX’s oversight) are willing to pursue this speaks volumes. Internet Capital Markets are not just cypherpunk dreams; they are starting to manifest in traditional venues.

Beyond that example, we’re seeing more real-world asset (RWA) tokenization momentum. Governments and large institutions are experimenting with issuing bonds onchain, or enabling stock trading via tokens. Just recently, Hong Kong green-lit the listing of ETFs that invest in crypto, and multiple European banks have issued tokenized bonds (UBS did a CHF 400 million tokenized bond in late 2022, for instance). In the U.S., Nasdaq and others have run pilots for private stock ledgers on blockchains. These are all early signals that the concepts of ICM are permeating outward. When I see a jurisdiction like Kazakhstan leap ahead with a bold onchain IPO initiative, it reminds me of how emerging markets often embrace innovation faster (where legacy powers hesitate). That leads to the next insight.

Frontier Markets: Leapfrogging to Internet Capital Markets

Why did AIX in Kazakhstan, of all places, pioneer an onchain IPO concept before, say, the NYSE or London Stock Exchange? To me, it’s the classic leapfrog phenomenon. Just as many developing regions skipped landline telephones and went straight to mobile, or adopted mobile banking while Westerners were still writing checks, we’re seeing frontier markets ready to skip some stages and adopt blockchain-based finance to leap ahead. An emerging market often doesn’t have the decades of built-up financial infrastructure (or entrenched incumbents defending it), so they are more open to trying something new if it promises a leap in efficiency or inclusion.

In fact, back in 2018 an analyst named Paul Domjan noted that frontier markets may be positioned to leapfrog developed economies by using blockchain and cryptocurrencies. That quote stuck with me. In the same way smartphones brought greater change to developing countries than the developed (by bringing banking and internet to people who never had it), blockchain can bring transparent, global markets to places that lack strong capital markets. It’s no coincidence that Kazakhstan, Abu Dhabi, Singapore, and other up-and-coming financial hubs have been proactive in creating crypto-friendly frameworks – they see a chance to attract capital and businesses by being ahead on this new paradigm. If you’re a country without a deep Wall Street of your own, why not try to become a hub for digital capital markets and draw in global liquidity via the internet?

Frontier markets also stand to benefit the most from the openness and efficiency of ICM. Consider the problems entrepreneurs face in, say, parts of Africa or South Asia: local capital is scarce, and accessing global investors is hard due to currency controls, underdeveloped stock exchanges, etc. Internet Capital Markets blows those barriers away. A startup in Nigeria could issue a token to global backers without begging local banks for a loan. A farmer in India could someday tokenize future crop yields to get financing onchain. These things sound futuristic, but they are increasingly plausible as onchain infrastructure matures. Because open protocols don’t discriminate by geography, talent, and projects in frontier markets can tap into global pools of capital more easily than ever. We already saw this with the ICO boom – teams from all over the world raised funds on Ethereum without a Silicon Valley VC in sight (for better or worse). The next wave will be more structured and sustainable, connecting real economies to global capital via blockchain rails.

In many ways, emerging economies have the most to gain from ICMfi. They can attract foreign investment by offering regulatory clarity for onchain markets (the way Kazakhstan is doing). They can modernize their financial infrastructure faster by integrating blockchain (less legacy to uproot). And their populations can benefit from services like stablecoin access (hedging local inflation) or DeFi yields when local banks pay nothing. It’s analogous to how M-Pesa mobile money took off in Kenya to fill a void, leaping far past Western banking tech. I suspect the first nation-scale implementations of decentralized capital markets will happen in these frontier environments – and ironically, that success will prod developed markets to follow suit or risk falling behind.

AI Agents: When Capital Markets Run Autonomously

No discussion of the future of finance would be complete without touching on AI. We’ve talked about human institutional players in capital markets – but one of the most fascinating (and borderline sci-fi) aspects of permissionless protocols is that non-human actors can participate directly. In ICM, you don’t need a passport or a physical presence to own assets or execute trades – all you need is a public-private key pair. This means that an algorithm, an AI agent, could hold and move capital just as easily as a person. We are already seeing glimmers of this: on-chain trading bots operate liquidity pools and arbitrage opportunities 24/7, entirely autonomously. But looking ahead, it goes much deeper.

Imagine an AI that acts as an investment manager – not just giving recommendations, but actually holding assets and executing strategies trustlessly onchain. With DeFi and DAOs, this is feasible. A smart contract can own other assets, meaning an AI-controlled contract could run its own treasury. We could soon have AI-driven hedge funds or treasury management DAOs where AIs rebalance portfolios based on market conditions, all transparently onchain. In fact, former regulator Brian Brooks predicted that “self-driving banks” will be a reality before self-flying cars – highlighting how automated financial agents may outpace even our transportation tech.

The pieces are in place: blockchains provide a trustless playground where an AI agent can plug in and use financial primitives without needing a legal entity or permission. It can trade on a DEX, lend on Aave, provide liquidity on Uniswap, or vote in a DAO governance – all it needs is some capital (which it could earn or be assigned) and code to decide its actions. In a very real sense, smart contracts are programmable financial agents, and when imbued with AI logic, they become autonomous market participants. We’re talking about a world where your market competitor or consortium member might not be human at all, but an algorithm tirelessly optimizing a strategy.

This convergence of AI and DeFi is already being hailed as the next frontier. Industry thinkers describe a coming era of “autonomous economies” where smart contracts are law, AI agents are economic actors, and blockchains are the settlement layer. In such a future, human roles shift more to setting parameters and ethical guidelines (“governance by humans”), while machines handle the execution at millisecond speeds and across countless micro-transactions. For example, an AI agent could automatically arbitrage between liquidity pools, or dynamically allocate a DAO’s treasury into hundreds of lending markets to maximize yield while managing risk, far beyond a human’s capacity to monitor. AI agents might even specialize – one focused on finding credit opportunities, another on market making for long-tail assets, etc., all coordinating via smart contracts.

Crucially, the permissionless nature of DeFi is what allows AI to plug in without asking anyone’s permission. An AI doesn’t need to open a bank account or get approved as an NYSE market maker; it just interacts with open protocols. This opens the door to a new era of autonomous capital. We’ll likely see AI-managed funds that people can contribute to, AI “advisors” that not only advise but execute changes to your portfolio in real-time, and AI participants in governance (yes, imagine AI voting on DAO proposals based on how it perceives the best interests of its token holdings!).

Is this scary? Maybe a little – the idea of algorithms controlling capital with minimal human intervention raises valid concerns (what if they go rogue or collude?). But it’s also incredibly exciting. Done right, it could mean more efficient markets and liquidity, and even the ability to achieve financial outcomes (like complex arbitrage or risk hedging) that no single human or team could manage manually. Blockchain records also make it auditable – every AI action can be logged for review, creating a tamper-proof audit trail in case an AI needs to be reined in.

The bottom line is that AI will participate in Internet Capital Markets as first-class citizens. We are already seeing the beginnings: experimental protocols where AI agents execute DeFi strategies, and discussions about “DefAI” (decentralized finance AI) as a sector. One Binance research piece noted that in the coming autonomous economy, human governance shifts to setting parameters while machines handle execution. This trend will only grow. It’s a wild concept – capital markets where not only are intermediaries optional, but even the investors and operators can be non-human intelligence. Yet it feels like a natural extension of where we’re headed, given the trajectory of automation. If you accept that algorithms already dominate Wall Street trading (high-frequency trading, algorithms managing index funds, etc.), extending that to fully onchain, self-governing AI entities is not a huge leap.

For builders and founders, this means designing protocols that are AI-friendly – exposing clean data and APIs, allowing smart contract wallets to interact, maybe even tailoring products to algorithmic “users” rather than just humans. And for all of us, it means rethinking what a “participant” in a financial market can be. In ICM, it could be you, your neighbor, or an AI avatar arbitraging yield – all on equal footing.

The Superpowers of Internet Capital Markets (What Makes ICM Different)

So why bother with on-chain finance at all? If it has so many gaps and risks, what makes this worth pursuing? The short answer: ICM has superpowers that TradFi simply can’t match, rooted in the internet’s open, permissionless, and community-driven nature. These unique possibilities are why I’m convinced ICM isn’t just a niche, but the future of finance. Here are a few of those superpowers:

Composability (Money Legos): In DeFi, every asset and protocol is like a Lego brick that can snap onto others. This composability means you can build complex financial products by stacking protocols together – often permissionlessly. For example, you could take a stablecoin issued on one platform, deposit it into a lending protocol to earn interest, then take the interest-bearing token and use it as collateral on another platform to borrow something else – all in a few clicks, without asking anyone’s permission. This is virtually impossible in TradFi, where combining services across institutions is slow and restricted. Composability accelerates innovation: someone can invent a new financial product by writing a bit of code that taps into existing protocols (e.g. a yield aggregator that routes through multiple lending platforms) – akin to how developers compose software libraries. It’s an open-source financial system, which means exponential innovation at internet speed. We saw a hint of this during the DeFi summer of 2020 when protocols like Yearn coordinated with others to maximize yields. The possibilities are endless when everything is interoperable by default.

Permissionless Architecture: This is fundamental. Anyone can participate in Internet Capital Markets – as a builder, investor, or user – without needing prior approval. Just as anyone could start a blog or YouTube channel and potentially reach millions, anyone can launch a token or provide liquidity or create a financial app on-chain. This open access unleashes creativity and global participation in a way TradFi’s gated system never could. It also means innovation isn’t bottlenecked by gatekeepers. If you have a new idea for how people can exchange value, you don’t need to buy a seat on the NYSE or get a bank charter; you just write a smart contract. There’s a famous mantra in crypto: “Don’t ask for permission, just build it.” The result is an explosion of experimentation – most will fail, but some will redefine finance. Permissionlessness also dramatically lowers the barrier for investors: On a DeFi platform, a teenager in India can invest $50 in a synthetic stock pool or a DAO token, whereas in TradFi that same person might be barred by income requirements or local restrictions from buying U.S. equities or startup equity. We are moving toward a world where capital markets are as open as the internet itself.

Community Capital Formation: This is one of my favorite aspects of ICM. It’s community-driven in a way finance has never been before. With tokens and DAOs, a group of people on the internet who believe in a project or a vision can pool their capital and their talent to make it happen. They are not passive investors; they become active contributors, evangelists, and governors. We’ve seen communities raise funds to bid on rare collectibles (like ConstitutionDAO), to back protocol development, or to support social causes – all through token-based crowdfunding. This flips the investor-founder dynamic on its head. In TradFi, capital formation often meant convincing a few rich investors in a boardroom. In ICM, it means rallying a like-minded community online. The community provides funding because they believe in the mission (or sometimes just the meme), and in return they gain not just financial upside but a stake in the community’s governance or identity. This kind of community ownership model can create extremely strong network effects – users and investors are the same, aligned toward growing the project. It’s like turning your early adopters into your shareholders from day one. I’ve experienced this firsthand, seeing a DAO treasurer or a volunteer developer working passionately because they own a piece of the outcome. Community capital formation also unlocks funding for ideas that might never fit traditional VC metrics but resonate with a niche group. It’s a democratization of both investing and value creation.

Narrative as Liquidity: This is a distinctly crypto-native concept that still boggles TradFi people. In the on-chain world, stories and memes themselves can drive capital. A compelling narrative – say the promise of a decentralized “X” or a meme coin about cute dogs – can ignite a frenzy of buying that provides real liquidity and market cap to a project. In traditional markets, liquidity generally chases fundamentals or at least established metrics; in ICM, liquidity often chases narrative momentum. We’ve seen tokens skyrocket simply because a narrative caught fire on Twitter or Reddit. As an investor, I’ve had to adapt to this reality: attention is literally an asset class in crypto. This is why you’ll hear the phrase “narrative liquidity” – it refers to the fact that a powerful story can be translated into market value in record time. This can be dangerous (bubbles form easily), but it’s also an opportunity. It means marketing, community-building, and meme-crafting are not fluff; they are integral to early-stage liquidity and price discovery in ICM. It’s a world where the best storyteller often wins the first funding round (the token launch). On the flip side, if your narrative loses steam, liquidity can vanish just as quickly. As a builder, this means thinking deeply about how to communicate your vision to an open audience of retail participants who may not read a whitepaper but will ape into a token that feels aligned with a zeitgeist. In summary, crypto markets run on a mix of technology and narrative fuel – and narrative can be as potent as code. This dynamic simply has no parallel in TradFi (perhaps the closest is the importance of brand in consumer stocks, but it’s not nearly as fast or dramatic). Understanding narrative liquidity is key for any crypto founder or investor.

Each of these attributes – composability, openness, community-driven funding, narrative-fueled liquidity – contributes to why Internet Capital Markets are qualitatively different from the status quo. They enable things like: a social media meme becoming a multi-million dollar asset overnight; or a protocol upgrade being decided by tens of thousands of token holders; or a developer in Vietnam integrating five DeFi protocols to launch a new product in a week. This is a Cambrian explosion in financial innovation, and it’s happening in real-time on public blockchains.

A $100 Trillion Opportunity – Parallels with Past Tech Shifts

Let’s step back and consider the sheer scale of what’s at stake. The global capital markets – equities, debt, etc. – are enormous, on the order of tens of trillions to hundreds of trillions of dollars. For context, the total value of global equities hit $100 trillion for the first time in 2020, and the global bond market likewise has surpassed $100 trillion outstanding. Add in real estate, commodities, derivatives – we are talking hundreds of trillions in value that the existing financial system intermediates. This is the TAM (Total Addressable Market) of the Internet Capital Markets revolution. It doesn’t mean all of that will move on-chain (or that it should), but it means even a small percentage disruption is a monumental opportunity. If even, say, 5% of $100T shifts into new on-chain forms over the coming decade, that’s a multi-trillion dollar transformation – comparable to the entire market cap of today’s crypto industry multiplied several times over.

I compare the moment we’re in to other inflection points in tech history. The personal computer revolution in the 1980s digitized many workplace processes and created giant new companies (Microsoft, Apple). The internet revolution in the late 1990s and 2000s transformed information distribution, spawning Google, Amazon, and countless others, while demolishing incumbents that didn’t adapt (think Blockbuster, newspapers, etc.). The mobile revolution of the 2010s put a supercomputer in everyone’s pocket, enabling entirely new services like Uber (real-time ride hailing with GPS) or WhatsApp (free instant global messaging) that would have sounded like science fiction before. Each time, the pattern was similar: a new platform emerges (PC, web, smartphone), incumbents scoff or ignore it at first, then it gradually absorbs and expands their markets, creating far more value than it initially seemed to threaten.

We are seeing early signs that on-chain finance is that next platform shift for capital markets. For instance, consider how quickly new crypto phenomena can achieve scale: When I see a platform like Believe (an ICM platform where anyone can launch a token via a tweet) mint nearly 10,000 tokens and facilitate $400+ million in trading volume with 190,000 traders in just months, it reminds me of the early days of the App Store or social media – a sudden unlocking of creativity and participation at scale. It’s chaotic and messy (just like early apps or early YouTube content were), but it’s undeniably a new, open playing field for capital formation. Today the whole ICM token market is still tiny (around a few hundred million in cap), but if this follows the trajectory of prior tech shifts, that could be like saying “online video streaming” was tiny in 2005 before YouTube blew up, or “mobile apps” were a niche in 2008 before the iPhone took off.

We have parallels in the speed of value creation too. In the mobile era, WhatsApp was acquired for $19 billion just five years after founding – an unheard-of trajectory that equated to creating $4 billion of value per year, roughly $11 million of value every day of its existence. Crypto has seen similar velocity: new DeFi protocols hitting $1B in total assets in a year, tokens skyrocketing from near-zero to billions in market cap in months during bull runs. The point isn’t that everything in crypto is worth that much (many are not, and there are crashes), but that the pace at which things can grow on a global, permissionless network is extraordinary. It suggests that when product-market fit happens in this space, the adoption curve can be hyperbolic. Capital markets moving at internet speed is a very different beast than the slow, steady pace of traditional finance.

Another analogy: Think of how software ate media (my family’s story attests to that) – now it’s software eating finance. Marc Andreessen famously said “software is eating the world,” and indeed software-based networks like Uber, Airbnb, and Netflix devoured industries once thought untouchable by tech. Finance is one of the largest slices of “the world” left to eat – and arguably the most complex and heavily guarded. But the cracks are showing. Gen Z is as comfortable trading tokens on a decentralized exchange as they are trading stocks on a broker app. Talent is flowing from Wall Street into Web3 startups. Even traditional institutions are experimenting with blockchain tech for settlement and issuing tokenized assets. It feels like 1995 in internet terms – early, full of skeptics, but with that unmistakable momentum building.

If mobile gave us companies that reimagined services (rides, food delivery, communications) for a new platform, on-chain finance will give us companies and networks that reimagine value exchange and capital coordination. What new “Uber of finance” could emerge when you combine global liquidity pools, smart contracts, and community ownership? Perhaps it’s a decentralized exchange that eclipses NASDAQ in volume by trading any and all assets 24/7. Perhaps it’s a global DAO that funds and governs scientific research, succeeding where government grants lag. Perhaps it’s a whole suite of financial products for the metaverse economy that we can’t even conceptualize yet. We’re limited only by our imagination and the rate of adoption of these technologies.

To me, the opportunity is two-fold: disrupt the old and enable the new. Disrupting the old means taking those $100T in assets and gradually offering a better, more efficient, more inclusive way to manage them on-chain (for instance, replacing costly cross-border payment networks with instant stablecoin transfers, or moving bond settlements to a blockchain for speed and transparency). Enabling the new means creating products and markets that couldn’t exist before – like a token that represents rights to a viral internet meme’s brand, or fractionalizing an investment in a small indie creator’s project, or letting anyone in the world back a startup from day one. The historical pattern is that new technology first imitates the old (early cars were “horseless carriages” that looked like carriages) and then creates its own new paradigms (modern cars, highways, etc.). Right now, DeFi is partly imitating Wall Street (lending, trading, etc.), but ICM will also create completely novel financial primitives that have no TradFi analog.

Conclusion: The Next Big Thing (And Yes, You’re Early)

Standing at this juncture, with one foot in the legacy world of finance and one foot in the on-chain future, I feel the same electricity I did in the early 2010s watching YouTube dethrone TV. Back then, many smart people dismissed online video and social media as fads or toys. Similarly, many today dismiss crypto finance as a playground for gamblers and geeks. They see the wild speculation and the rough edges, but they miss the core innovation: a permissionless, global financial layer for the internet. That, in my view, is as transformative as the invention of the internet itself.

My thesis is simple. Internet Capital Markets Finance is the next big thing. It will redefine how we raise capital, trade assets, and share economic upside across communities. And if you’re building in this space now, you are early. Perhaps it doesn’t feel that way – crypto has booms and busts, and some days it seems everyone already knows about it. But relative to where this is headed, we are in Chapter 1 of a very long book. The total value locked in DeFi or the market cap of all ICM tokens is still a drop in the bucket of global finance. The user base of on-chain finance is maybe a few million at most, versus billions who use traditional financial services. Regulation and technology hurdles remain. All this means huge growth is ahead as these obstacles are overcome one by one.

Being early is a double-edged sword: there’s a lot of building to do, a lot of rough terrain before the paved roads. But that also means the biggest opportunities are still up for grabs. The first web startups that grasped the magnitude of the internet (Amazon, Google) became titans. The first mobile-first apps that exploited the smartphone’s capabilities (Uber, Instagram) changed entire industries. Likewise, the pioneers of ICMfi – those creating the foundational platforms, solving the unsolved problems, and shaping the narratives – stand to ride the next massive wave of value creation.

I’ve learned from my family’s story that technology waves stop for no one. You can either resist until you’re obsolete, or you can embrace the wave early and lead the charge. I chose to become a builder/investor in this on-chain revolution because I recognize the rhyme of history. The same patterns that upended media are beginning to upend finance. The scale of finance is even larger, and thus so is the potential impact. We have the chance to make markets more accessible, fair, and innovative – to bring 5.5 billion internet users into a global capital market on their own terms. That’s a legacy worth chasing.

To anyone reading this who is already working on Internet Capital Markets: keep going, you’re not crazy – you’re early. And to those on the fence: the train is leaving the station, but it hasn’t yet hit full speed. The next decade could see an explosion of on-chain financial innovation that makes the last decade of fintech look timid. ICMfi is how we will onboard the world’s capital to the internet, and in doing so, rewrite the playbook of finance. Just as I saw with YouTube versus TV, there will be disbelief and scoffing at first – and then, suddenly, those who underestimated the internet will find themselves years behind.

As a founder or investor, you don’t want to be on the wrong side of that pattern. This is the next big thing. If you’re building here now, congratulations – you are among the pioneers of the Internet’s financial revolution. And if we succeed, the story of how TradFi gave way to ICM will be the case study future generations read, just like we study how the internet disrupted everything before.

The future of capital markets is being written in code today. It’s time to log on. We’re still early – but not for long. Let’s build the future of finance, together, in the open, on-chain.